Do you live and work remotely?

To let you fully focus on your business, Protrip World Traveler has you covered. Our international insurance protects you from high medical costs and can be purchased online anytime.

On the go and need protection right now?

Get your insurance online in just a few minutes – no matter where you are. No annoying paperwork required.

As flexible as you are.

Whether it’s 2 weeks or 12 months – you decide the duration. You can request an extension anytime.

Worldwide protection, anytime, anywhere.

Whether it’s a doctor’s visit in Thailand, medication in Colombia, or an emergency in the US – we cover your costs worldwide so you don’t have to worry.

Your homecoming bonus:

Back home for a short visit and caught the flu? We’ve got you covered during your stay at home for up to 6 weeks.

Fair conditions:

No hidden fees. Your transparent deductible gives you full control over your costs.

Our insurance was designed especially for people like you. It offers flexibility and comprehensive coverage that has your back in every situation.

Your health assistant on the go.

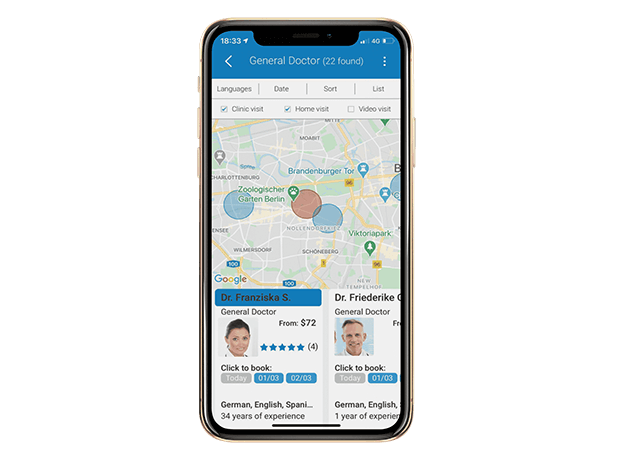

The Air Doctor app—part of your protection.

We know how unsettling it can be to get sick abroad. With the Air Doctor App, included in your insurance coverage, you’re never alone.

Find and book qualified doctors in over 70 countries, check their profiles, and get medical care without language barriers.

This way, you can fully focus on your trip while we take care of your health.

Insurance Terms and Product Information

Please refer to the complete services in the Consumer Information Protrip World Traveler .

A brief overview of the key contents of your insurance is provided in our Product Information Sheet Protrip World Traveler .

-

What does deductible mean?

A deductible means that you have to bear a certain financial share yourself in the event of a claim. Classic insurance policies that have a deductible include private health insurance, car insurance and professional liability or public liability insurance.

The deductible, also known as the excess or personal contribution, is normally deducted per claim. If an insured event occurs, the insurance will cover the costs exceeding the deductible, but only up to the agreed sum insured.

If you opt for a higher deductible, you may be able to get a lower insurance premium. This is because a higher excess is advantageous for the insurer. In such cases, the insurer does not have to deal with small claims and the associated processing costs are eliminated.

-

How can the premium be paid?

When paying by SEPA direct debit or credit card, we offer you the option of paying the premium monthly. Alternatively, a one-time payment for the entire insurance period is also possible.

All other payment methods are only available for a one-time payment for the entire duration of the insurance.

You can choose from the following payment options:

- Credit card

Monthly or one-time payment possible:

MasterCard, VISA, Bancontact, Diners Club, DISCOVER, Maestro

One-time payment possible:

AMERICAN EXPRESS

- SEPA Direct Debit

Monthly or one-time payment possible

- Online banking:

SOFORT, eps, iDEAL

- Online payment system:

PayPal, Apple Pay

The premium for this policy depends on the duration of the trip. Should you return early from your stay abroad, a phone call or an email is sufficient. We will then calculate your exact premium depending on the number of days you stayed abroad. You only need to pay for the actual insurance period. No service fee will be charged for reimbursement.

For countries in the euro-zone:

Where the term of insurance exceeds one month, you can also pay in monthly installments via SEPA Direct Debit. The first installment becomes due at the start of insurance, the subsequent installments at the start of each following month. - Credit card

-

I'm already traveling abroad. Can I still take out the insurance now?

Yes, this is easily possible with us. Many insurers require that the policy be taken out before departure. We understand that plans can change – which is why you can also take out the Protrip World Traveler online from abroad. Anytime.

Important to know:

- Accidents are covered immediately: Protection in case of accidents applies without any waiting period.

- For illnesses: There is a 14-day waiting period from the start of the policy. This means treatments for illness are covered from day 15.

-

What does the insurance cost?

The costs depend on your age, the chosen duration, and your travel destination. The exact monthly premiums are transparently available in our premium table directly on this page.

-

Can I also extend the insurance?

-

Does the insurance also cover sports activities?

Digital nomads rarely live without risk. A reliable travel health insurance takes this into account and also covers these risks – without you having to limit yourself.

The following are excluded: motorcycle or car racing, including, training for such events, parachuting, paragliding, bungee jumping, basejumping, mountain climbing (if this requires special climbing equipment), free climbing, and sports and equipment diving. Participation in professional sports.

-

What happens in case of an emergency?

Through the Air Doctor App, you can quickly find a trusted doctor nearby who speaks your language. For any major emergencies or questions, our 24/7 emergency hotline is always there for you. You’re never alone.

Perhaps the most important point: In an emergency, every minute counts. A good insurance policy not only organizes doctor visits or hospital stays, but also ensures quick assistance in the local language, covers advance payments in countries with high treatment costs, and arranges repatriation if necessary. It’s not just about finances – it’s about reliability when you need it most.